CPO Prices Expected to Remain Range-Bound Between RM4,100–RM4,400 on Seasonal Supply Decline

Crude palm oil (CPO) prices remained firm throughout January, despite lingering fundamental headwinds. Market attention has shifted back to core fundamentals—namely production, export performance and stock levels—following Indonesia’s clarification that the rollout of its B50 biodiesel programme will be postponed due to unfavourable price dynamics between palm oil and gas oil.

Heading into February, palm oil prices are expected to be shaped by the following key factors:

Improving Relative Price Competitiveness

Premiums for both soybean oil and sunflower oil widened against palm oil in January, further enhancing palm oil’s relative price competitiveness. As a result, global import demand for palm oil is expected to overtake soybean oil in Q1 2026. In parallel, optimism is building that U.S. domestic soybean oil consumption will increase, supported by greater clarity on U.S. biofuel policy expected in early March.Price Resilience Amid Softening Fundamentals

Palm oil prices have remained resilient despite unfavourable developments, including the delay of Indonesia’s B50 biodiesel mandate and elevated stock levels in Malaysia. This resilience suggests that current prices are forming a near-term structural floor, with limited downside risks.Large Brazilian Crop Weighing on Soybean Prices

Soybean fundamentals remain weak as favourable weather conditions continue to support a strong Brazilian harvest. Brazilian soybean production is now projected to exceed 180 million tonnes in 2026, up from an estimated 178 million tonnes in late 2025. Ample supplies are expected to intensify export competition with the United States, exerting further downward pressure on soybean prices.

A Brief Market Recap

Indonesia announced that it will raise export levies on both crude and refined palm oil by 2.5%, effective 1 March 2026. The export levy on crude palm oil will increase from 10.0% to 12.5%, while the levy on refined palm olein will rise from 7.5% to 10.0%. Proceeds from the levy are channelled towards subsidising Indonesia’s domestic biodiesel programme.

China became a net exporter of soybean oil for the first time in 2025 and is expected to maintain this position in 2026. Between January to November 2025, China imported 336,000 tonnes of soybean oil while exporting 439,000 tonnes, with India, South Korea and North Korea accounting for 64% of total exports.

Venezuela faces near-term production risks amid continued U.S. government intervention in its oil sector, although the medium-term outlook has improved. Despite holding the world’s largest crude oil reserves, production remains constrained by sanctions and underinvestment. A more stable government that normalises relations with the United States could unlock significant investment, boosting Venezuela’s oil output over the medium term.

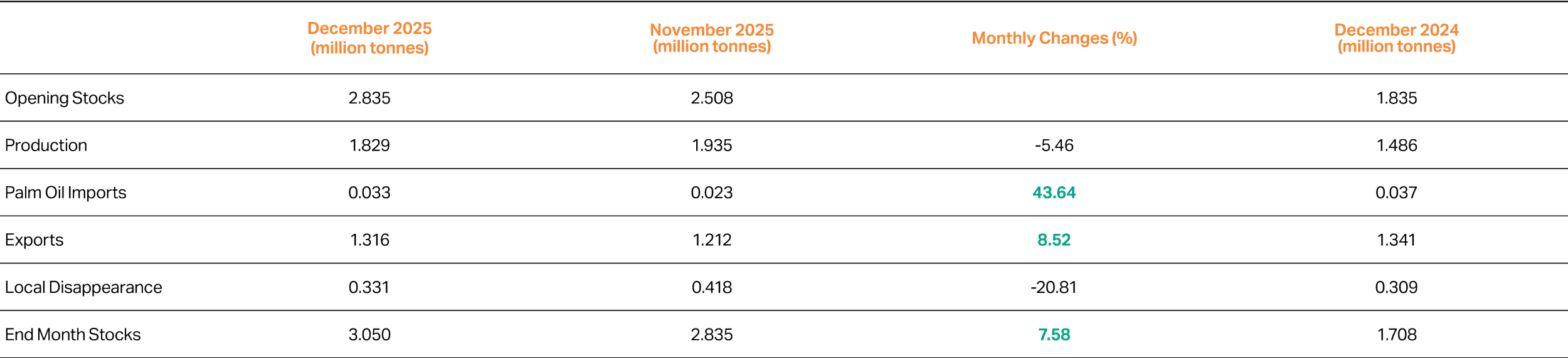

Malaysia's Palm Oil Supply and Demand for December 2025

Table 2: Monthly statistics of Malaysian palm oil for December 2025 (MPOB, 2026).

Palm Oil Supply and Demand Dynamics in February: Key Changes and Trends

Malaysia’s palm oil production declined by 106,000 tonnes (-5.5%) month-on-month in December, but rose by 343,000 tonnes (+23.1%) year-on-year. For full-year 2025, production increased by 945,000 tonnes (+4.9%) to a record 20.3 million tonnes. The improvement was underpinned by a moderate monsoon in Q4 2025 and improved harvesting activity, which reduced harvest losses.

Exports rebounded by 104,000 tonnes (+8.5%) in December 2025 to reach 1.31 million tonnes. Despite the month-on-month improvement, December shipments remained relatively subdued as India’s palm oil imports stayed weak. Export performance has yet to fully reflect palm oil’s improved price competitiveness against soft oils, although this dynamic is expected to shift

in the coming months as demand improves.

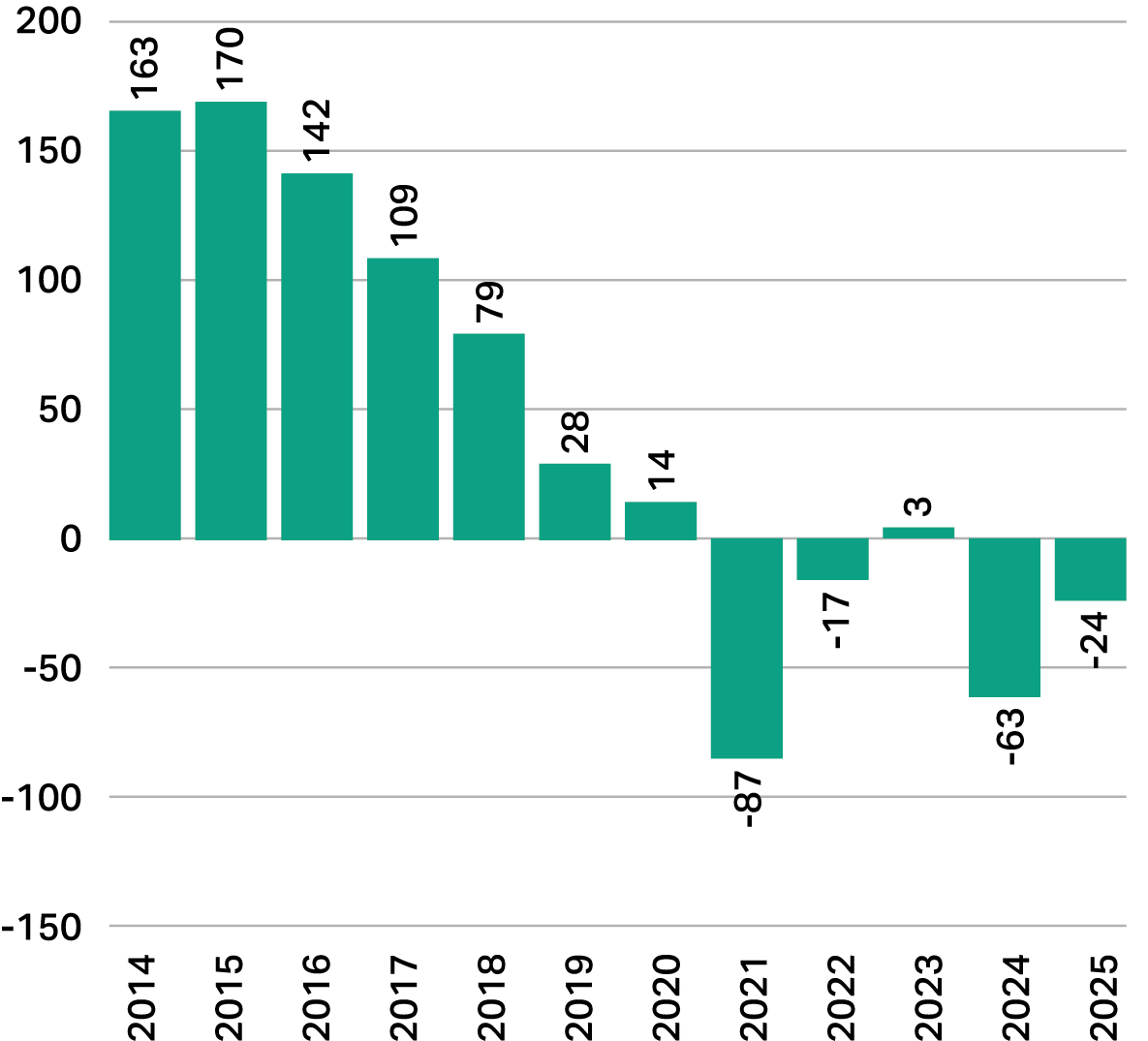

Changes in Mature Oil Palm Planted Area ('000 hectares)

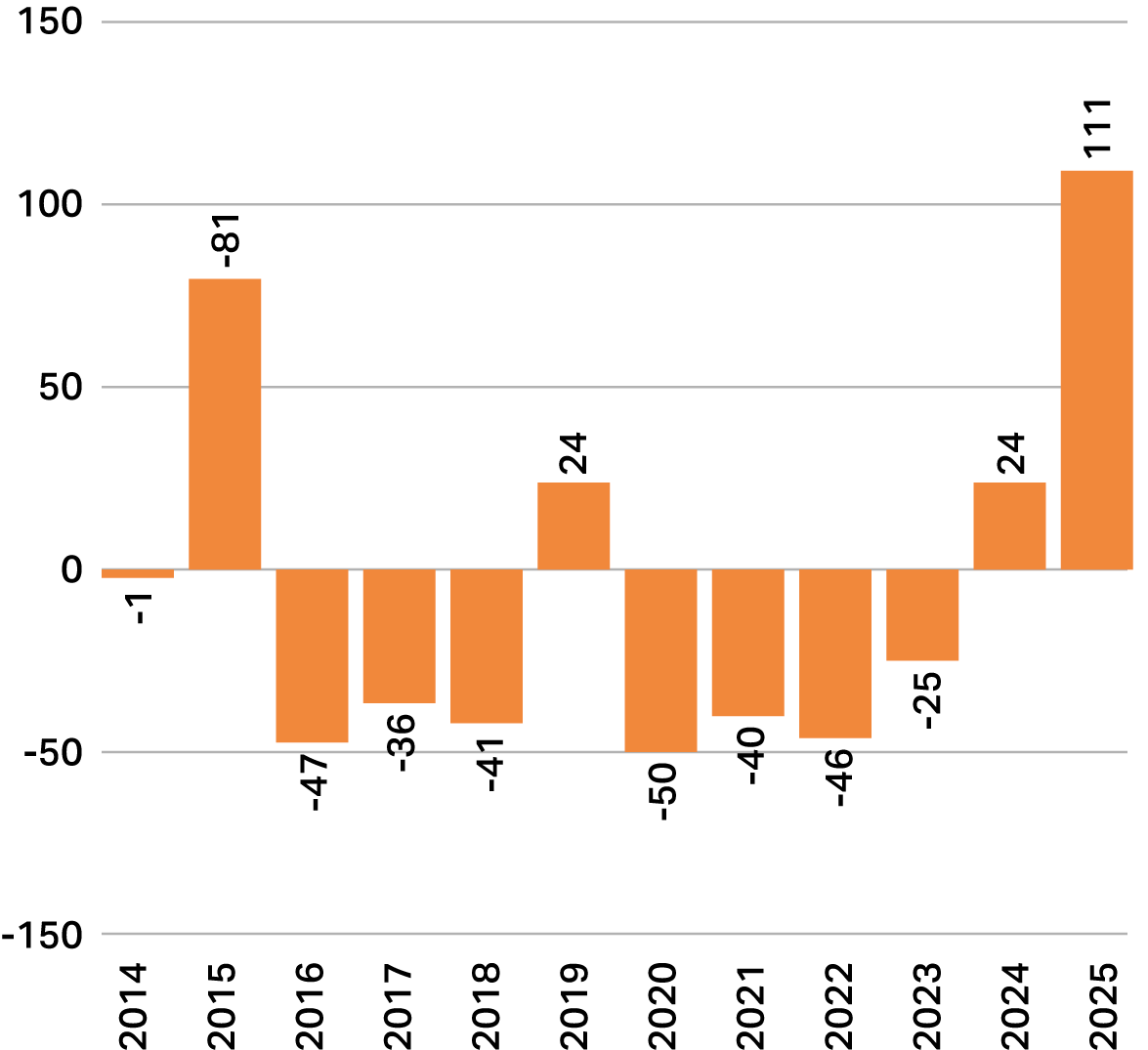

Changes in Immature Oil Palm Planted Area ('000 hectares)

Figure 4: Changes in mature and immature oil palm planted area in Malaysia, from 2014 to 2025 (MPOB, 2025).

Despite record production, Malaysia’s total oil palm planted area remained broadly unchanged at 5.7 million hectares in 2025. Mature planted area declined by 24,000 hectares (see Figure 4), while immature planted area expanded by 111,000 hectares, as the replanting rate improved to 3.4% in 2025 from 2.0% in 2024.

Malaysia’s palm oil production in 2026 is projected to decline moderately to 19.8 million tonnes, as replanting temporarily reduces the effective production area and oil palm trees enter a natural resting phase following strong output in the final quarter of 2025. Meanwhile, exports in Q1 2026 are expected to improve year-on-year from a low base in Q1 2025.

Palm Oil Price Outlook: Consolidation Phase Ahead of Policy and Demand Catalysts

Vegetable oil prices showed mixed performance in January. Sunflower oil surged by 13.9% month-on-month to USD1,560 per tonne in the European market, driven by tight export supplies and a renewed geopolitical risk premium following recent Russian attacks on sunflower oil storage facilities in Ukraine. As a result, sunflower oil traded at a steep premium of around USD190 per tonne over palm oil by mid-January.

In contrast, rapeseed oil prices fell 4.3% month-on-month, palm oil declined 1.2% and soybean oil slipped marginally by 0.5%. The sharp correction in rapeseed oil pushed its price below palm oil, giving palm oil a temporary premium of USD23 per tonne. This shift reflects expectations of a bumper EU rapeseed crop in 2026, projected at 20.4 million tonnes—the second highest output in a decade—alongside weak Chinese demand for Canadian canola.

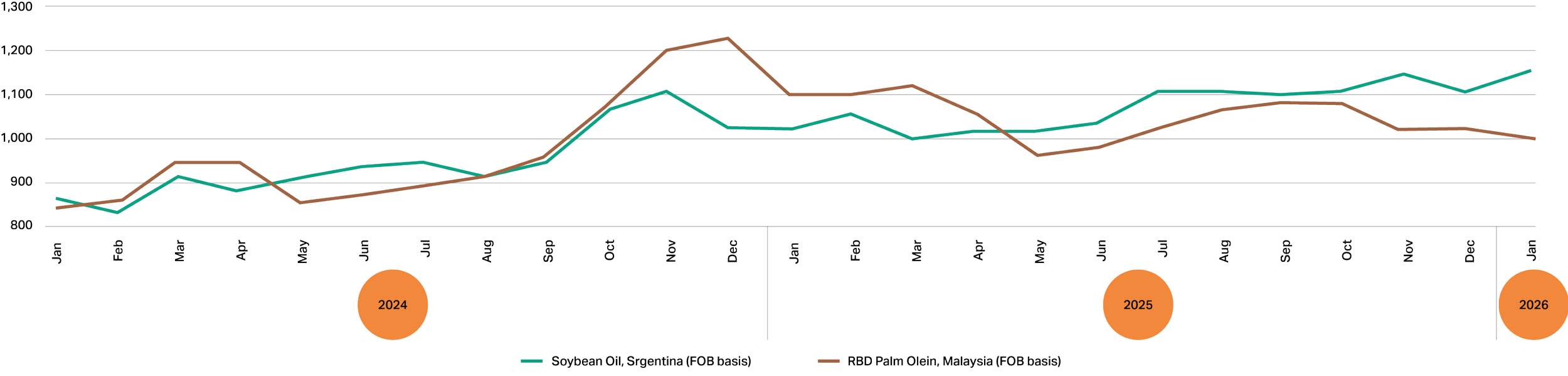

Argentine Soybean Oil And Malaysian RBD Palm Olein Prices (USD per tonne)

Figure 5: Argentine soybean oil and Malaysian RBD palm olein prices, FOB basis (Oil World & MPOB, 2026).

Global import demand for palm oil is expected to strengthen and potentially surpass soybean oil in Q1 2026. Soybean oil prices in Argentina reached a two-year high in January and traded at a premium of USD140 per tonne over Malaysian RBD palm olein (see Figure 5). Similarly, in India’s domestic market, soybean oil commanded a premium of USD84 per tonne over palm oil.

Despite palm oil’s clear price advantage, India’s import demand for palm oil has yet to fully recover, likely due to the recent weakening of the Indian rupee against the Malaysian ringgit. This setback is expected to be temporary, as India will ultimately need to import palm oil regardless of currency movements, given its structural cost competitiveness.

In addition, Indonesia’s announced increase in the CPO export levy to 12.5% from 1 March 2026 is expected to improve Malaysia’s palm oil market share in India and contribute to a drawdown in domestic palm oil stocks.

Palm oil prices have remained firm above RM4,000 (USD1,020) throughout January despite lingering headwinds, including the delay of Indonesia’s B50 biodiesel mandate and elevated stock levels in Malaysia. This suggests that RM4,000 (USD1,020) is emerging as a near-term structural floor.

Seasonal factors are also expected to lend support. February’s shorter trading month, combined with multiple public holidays such as Thaipusam, Lunar New Year and the fasting month, is likely to reduce harvesting productivity and constrain near-term supply.

At the same time, optimism is building that U.S. domestic soybean oil consumption will increase, supported by greater clarity on the 45Z biofuel policy and Renewable Volume Obligations (RVOs) in early March. This is likely to help absorb domestic soybean oil and support crushing activity ahead of the large Brazilian soybean harvest between March and May 2026.

Looking ahead, palm oil prices in February are expected to remain range-bound between RM4,100 (USD1,045) and RM4,400 (USD1,122) per tonne, supported by seasonal declines in production and stocks. A sustained price rally would require either renewed speculation over a higher Indonesian biodiesel mandate, a recovery in crude oil prices, or clearer U.S. biofuel policy signals that significantly boost soybean oil demand.

Exchange Rate: USD1 = RM3.92