Analysis and Outlook for January 2026: Balanced Fundamentals to Keep CPO Prices Between RM3,800 and RM4,100

Palm oil’s price competitiveness has strengthened further relative to soft oils, which is expected to translate into a pickup in global palm oil demand. In 2025, one of the key surprises in the palm oil market was the sharp improvement in Malaysian production, which climbed to a record high of 20 million tonnes, driven by robust output in October and November. This surge in supply weighed on crude palm oil (CPO) prices, which retreated from a peak of RM4,610 (USD1,127) in October to RM3,928 (USD9,60) by December 2025.

Trade and biofuel policies were the dominant forces shaping palm oil and broader vegetable oil prices throughout 2025 and are expected to remain key drivers into 2026. Heading into January, palm oil prices are likely to be influenced by the following key factors:

Improved price competitiveness

Palm oil’s price competitiveness has strengthened further relative to soft oils, which is expected to translate into a pickup in global palm oil demand. Growth in vegetable oil consumption in 2026 is projected to be driven mainly by palm oil and rapeseed oil, while consumption of soybean oil and sunflower oil is likely to remain largely stagnant.Balanced palm oil supply-demand dynamics

Palm oil stocks remain elevated in Malaysia, while inventories in Indonesia are declining. Taken together, there is no immediate concern of oversupply. The first quarter is typically a seasonal low for production, during which inventories tend to decline, keeping the near-term supply-demand outlook broadly balanced.Ample soybean supply weighing on sentiment

Abundant global soybean supplies are expected to continue weighing on market sentiment, as oilseed availability remains ample. Global soybean stocks are projected to accumulate to a burdensome 124 million tonnes in 2026, the highest level in a decade.

A Brief Market Recap

The European Parliament has approved a 12-month delay to the EU Deforestation Regulation (EUDR), pushing the compliance deadline for large operators to 30 December 2026, while micro and small enterprises will have until 30 June 2027. The extension also includes a review clause that allows the European Commission to further simplify the policy framework.

Germany’s revised RED III legislation significantly tightens biofuel rules by ending the double-counting mechanism for advanced biofuel feedstocks, such as used cooking oil and waste oil, from 2026 onwards. In addition, palm oil and palm oil mill effluent (POME) will be phased out from 2027, with these feedstocks no longer eligible to meet biofuel blending mandates.

Malaysia is positioning itself as a regional hub for sustainable aviation fuel (SAF), with plans to introduce a SAF blending mandate for all international flights departing Kuala Lumpur International Airport (KLIA). Ecoceres Malaysia’s first SAF biorefinery in Johor has commenced operations, with an annual capacity of 400,000 tonnes. A second plant, jointly developed with Petronas, is expected to be completed in 2028, adding a further 650,000 tonnes of annual capacity.

Palm Oil Supply and Demand Dynamics in January 2026: Key Changes and Trends

Malaysia’s palm oil production declined by 108,000 tonnes, or 5.3% month-on-month to 1.93 million tonnes in November. Exports also fell short of expectations, reaching 1.21 million tonnes, largely due to weaker demand from Sub-Saharan Africa. The region imported nearly 600,000 tonnes in October, leading to lower import volumes in November. Demand from the

EU27 also softened after the European Union confirmed a further 12-month delay in the implementation of the EUDR, removing the need for importers to build precautionary stocks.

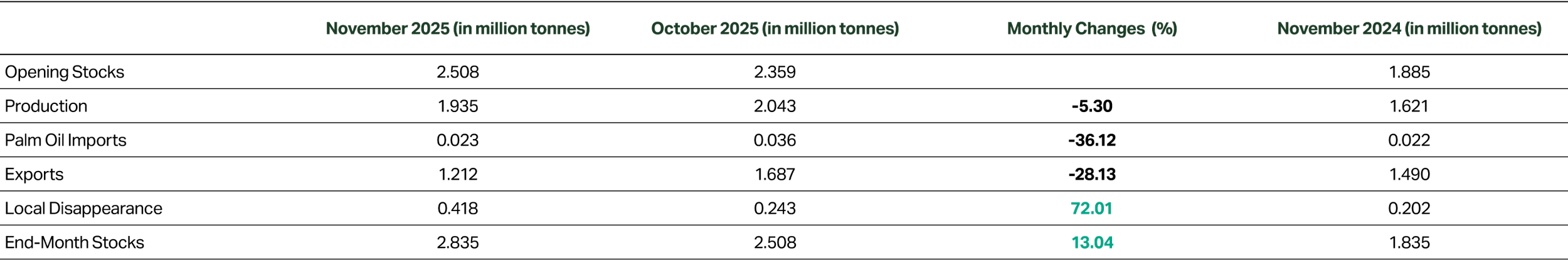

Malaysia's Palm Oil Supply and Demand for November 2025

Table 1: Monthly statistics of Malaysian palm oil for November 2025 (MPOB, 2025).

Malaysia’s palm oil production in 2025 is estimated at 20.1 million tonnes, a record high that surpasses the previous peak of 19.96 million tonnes in 2015. The increase was largely concentrated in the October to December period (see Figure 1), with output rising by 774,000 tonnes, or 16%, compared with the same quarter a year earlier. Production in the first quarter of 2026 is expected to rise year-on-year from a low base in Q1 2025, before moderating into year-on-year declines in the second and third quarters.

Malaysia: Quarterly Palm Oil Production ('000 tonnes)

Figure 1: Malaysia’s quarterly palm oil production, from 2019 to 2025 (MPOB, 2025).

Looking ahead to 2026, Malaysia’s palm oil exports are forecast to increase to 16.2 million tonnes, while production is expected to ease to around 19.7 million tonnes as oil palm trees enter a resting phase following their strong performance in 2025. High carry-over stocks are therefore likely to decline gradually over the coming months.

Palm Oil Price Outlook: Stability Amid Policy and Energy Market Headwinds

Sentiment across the vegetable oil market has been weighed down by falling crude oil prices, which dropped to USD55 per barrel in December 2025, the lowest level since February 2021. Persistently weak crude oil prices may require the Indonesian government to provide higher subsidies to support the expansion of its B40 biodiesel programme.

In the United States, soybean oil prices fell to a five-month low of USD1,130, as the US Environmental Protection Agency (EPA) expects President Trump’s 2026 biofuel policy—prioritising the use of domestically produced soybean oil—to be finalised only in the first quarter of 2026.

Palm oil prices were also weighed down by softer global sentiment, compounded by rising inventories in Malaysia. As a result, palm oil’s price competitiveness has improved further relative to soybean oil and other competing vegetable oils, which is expected to translate into a pickup in global palm oil demand in the near term.

In India, palm oil was trading at a discount of USD105 per tonne to soybean oil and USD240 per tonne to sunflower oil as of mid-December. As such, India’s palm oil imports are expected to improve notably between January and March, supported by a seasonal increase in demand during the wedding season.

In China’s domestic market, palm olein has become significantly more competitive, with its premium over soybean oil narrowing sharply from USD195 per tonne in the first quarter of 2025 to just USD20 per tonne in December 2025. Consequently, the recent weakness in palm oil prices is expected to be temporary and may present an attractive opportunity for key destination markets to rebuild inventories.

Palm oil stocks in Malaysia remain elevated, rising by around one million tonnes compared with a year earlier. In contrast, Indonesia’s stocks are expected to contract by year-end. Indonesia’s palm oil exports in 2025 are projected at 26.5 million tonnes, while domestic consumption is estimated at about 23 million tonnes, comprising approximately 10 million tonnes for food use and 13 million tonnes for biodiesel. Combined exports and domestic usage of about 49.5 million tonnes are broadly in line with estimated production of 49 million tonnes, implying a minor deficit in stocks. Collectively, the contrasting stock positions in Malaysia and Indonesia suggest there is no concern of oversupply.

Global Soybean production is projected to stagnate at 424 million tonnes in 2026. Even so, ample soybean supplies are expected to continue weighing on market sentiment, as oilseed availability remains abundant. Brazil is expected to harvest a very large soybean crop of around 178 million tonnes, accounting for roughly 42% of global production.

US soybean exports in the new marketing season declined by 46% between September and November, largely due to the absence of Chinese demand. Concerns are also mounting that the arrival of new South American soybean supplies from March onwards will further pressure US export prospects and prices. As a result, global soybean stocks are projected to accumulate to a burdensome 124 million tonnes in 2026, the highest level in a decade (see Figure 2).

Global Soybean Production and Ending Stocks (million tonnes)

Figure 2: Global soybean production and ending stocks, 2015/16 to 2025/26 (Oil World, 2025).

Looking ahead, palm oil prices in January are expected to remain range-bound between RM3,800 (USD929) and RM4,100 (USD1,002), underpinned by a broadly balanced supply-demand outlook. The first quarter is typically a seasonal low for production, while demand is expected to improve ahead of the Lunar New Year and Ramadan, supporting a drawdown in stocks. However, spillover weakness from the energy market, coupled with abundance oilseed supplies is likely to cap any sustained price recovery, keeping prices within a narrow trading range.

Exchange Rate: USD1 = RM4.09