Analysis and Outlook for December 2025: CPO Prices Poised for Rebound toward RM4,400 as Supply Tightens and Festive Consumption Rises

Crude palm oil (CPO) prices eased to RM3,968 (USD954) in November as Malaysia’s palm oil stocks rose to a six-year high, signalling a temporary easing in supply tightness. Market sentiment continues to be shaped by expectations surrounding Indonesia’s B45 or B50 biodiesel mandate, due for rollout in 2H 2026. Exceptionally strong production between July and October 2025 suggests output may decline more sharply than usual in December and into Q1 2026, as oil palm trees enter their biological resting phase. The onset of the monsoon in mid-November is also expected to hinder harvesting activities.

Heading into December, palm oil prices will be influenced by several key factors:

Firm Export and Domestic Demand

Recent price weakness is expected to sustain export demand in the near term. Domestic consumption is set to strengthen in January and February 2026, with both Chinese New Year and Ramadan falling in February.India’s Rising Reliance on Palm Oil

India’s dependence on palm oil is poised to increase as domestic soybean production is forecast to fall by 1.5 million tonnes (-13.5%) this season. Elevated sunflower oil prices and an anticipated decline in soybean oil exports from Brazil, Argentina and the United States in 2026 will further support higher Indian palm oil imports.Policy Uncertainty in Indonesia

Potential adjustments to export duties and the timeline for raising the biodiesel mandate represent key uncertainties for Indonesia’s palm oil export outlook. These policy variables will remain important market swing factors in the months ahead.

The month-on-month improvement in export performance was driven primarily by Sub-Saharan Africa, with shipments reaching a record 577,000 tonnes in October—accounting for 34% of Malaysia’s total exports for the month.A Brief Market Recap

The Ringgit has strengthened by more than 8% against U.S. dollar year-to-date in 2025, supported by Bank Negara Malaysia’s decision to maintain interest rates—reflecting confidence in the domestic economic outlook. Analysts expect the currency to remain within its current trading range for the time being.

Indonesia has announced plans to open 600,000 hectares of new land for oil palm cultivation over the next four years to meet rising food and energy demand, according to remarks by the Agricultural Ministry at the GAPKI conference (13–14 November). Of the total, 400,000 hectares will be allocated to plasma plantations and 200,000 hectares to state-owned enterprises.

China lifted most retaliatory tariffs on U.S. imports effective 10 November, however, it has retained the 13% duty on U.S. soybean imports even as purchases resume. This keeps U.S. supplies uncompetitive relative to South American origins.

Palm Oil Supply and Demand Dynamics in December: Key Changes and Trends

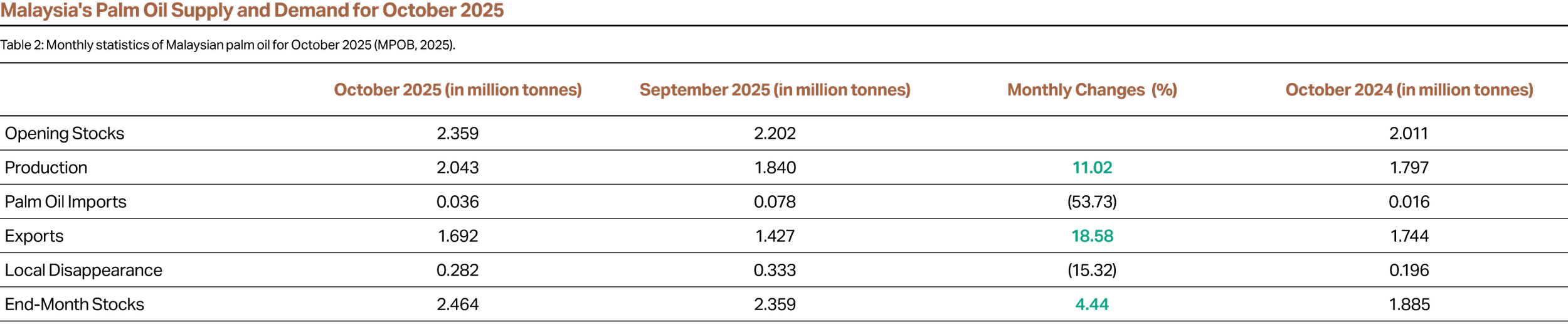

Malaysia’s palm oil production surged by 203,000 tonnes (+11.0%) in October, reaching its highest monthly output in a decade. Sabah led the month-on-month increase with an additional 72,000 tonnes (+19.5%), followed by Sarawak at 61,000 tonnes (+14.6%) and Peninsular Malaysia at 68,000 tonnes (+6.5%). The strong production performance was driven by the late arrival of the monsoon, improved fertilisation practices, and favourable rainfall patterns throughout 2024.

Exports in October also performed strongly, rising 265,000 tonnes (+18.6%) to 1.69 million tonnes. Sub-Saharan Africa contributed the most to this improvement, with shipments reaching a record 577,000 tonnes—equivalent to 34% of Malaysia’s total exports that month. Exports to China also increased, reaching a five-month high of 110,000 tonnes.

Malaysia’s palm oil stocks rose to 2.46 million tonnes in October, the highest level since April 2019 (see Figure 7), despite exports outpacing production. This indicates that the rise in stocks was driven by softer domestic consumption rather than production or export shifts. Moreover, Malaysia imported 708,000 tonnes of palm oil from Indonesia between January and October 2025—a 266% jump compared with 193,000 tonnes in the same period last year.

Production slowdown in Indonesia is already visible, with Malaysian imports from Indonesia falling to their lowest level of the year in October, down 53.7% month-on-month. Indonesia’s exports also fell to a five-month low of 1.7 million tonnes in September. The arrival of the seasonal low-production window typically strengthens palm oil fundamentals, as stocks are drawn down over the subsequent three months.

Malaysia's Palm Oil Supply and Demand for October 2025

Table 2: Monthly statistics of Malaysian palm oil for October 2025 (MPOB, 2025).

Palm Oil Price Outlook: Navigating Supply Recovery and Volatile Global Edible Oil Markets

Global palm oil prices softened by 4% in November amid continued inventory accumulation, while sunflower, soybean, and rapeseed oil prices held largely steady—widening palm oil’s discount to soft oils. As of mid-November, palm oil traded at a USD120 discount to sunflower oil, and USD48 and USD34 below soybean oil and rapeseed oil respectively.

This temporary widening of the discount is expected to stimulate import demand, especially in markets preparing for Ramadan. In 2026, Chinese New Year and Ramadan will coincide in February—a period when production is typically at its seasonal low due to reduced harvesting days. Historically, Ramadhan begins around a month after Chinese New Year, providing a buffer for stock building. The overlap is likely to drive domestic consumption in Malaysia and Indonesia higher than usual in January and February.

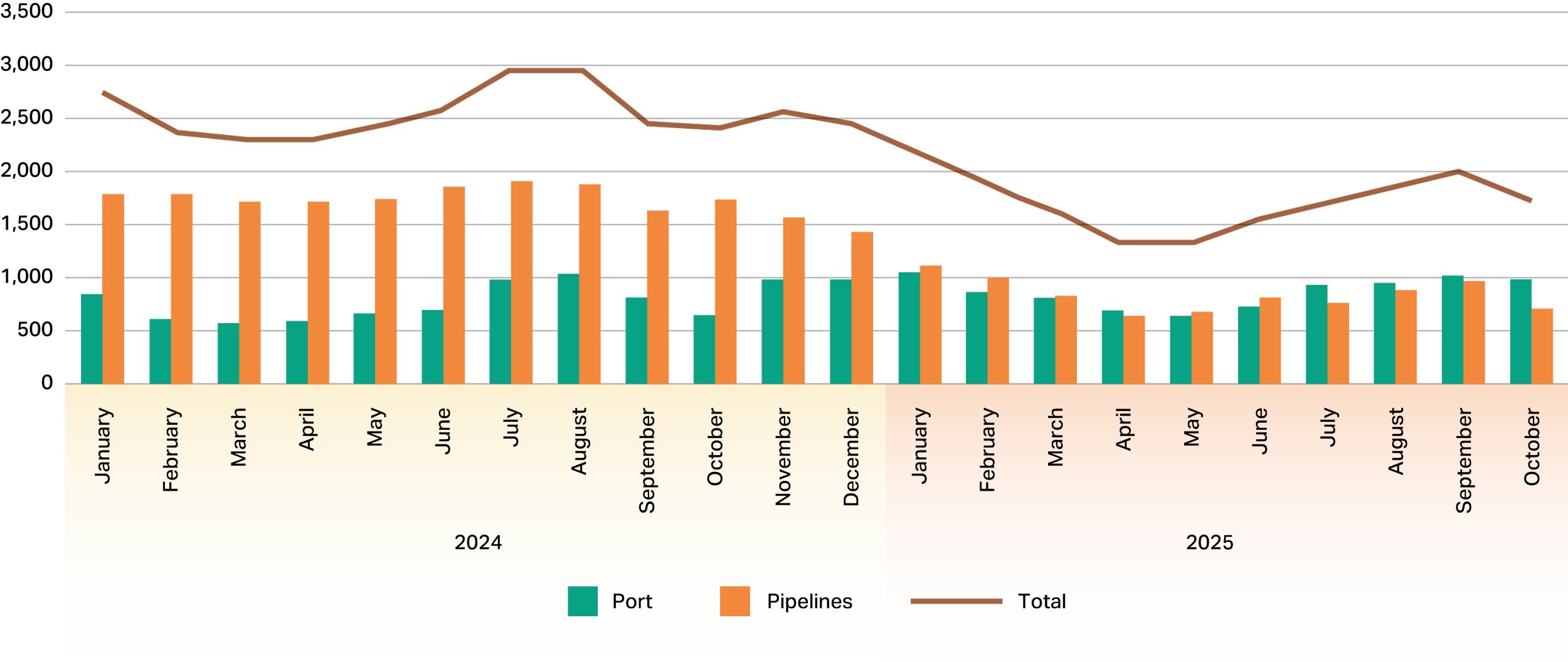

Throughout 2025, palm oil traded at either a premium or a narrow discount to soybean oil, limiting India’s palm oil imports. As a result, India’s vegetable oil stocks fell to 1.7 million tonnes in October 2025, significantly below the 2.4 million tonnes recorded a year earlier. Pipeline stocks remain sharply lower than port stocks, suggesting limited incoming shipments (see Figure 8). Indian refiners are therefore expected to take advantage of recent palm oil price weakness to replenish domestic inventories.

Indian Vegetable Oil Stocks at Port & Pipelines ('000 tonnes)

Figure 8: Indian vegetable oil stocks at port and pipelines, from 2024 to 2025 (SEA, 2025).

India’s reliance on palm oil is likely to rise further in 2026. Sunflower oil prices are set to remain elevated, while exportable supplies of soybean oil from Brazil and the United States are expected to shrink amid stronger domestic biofuel demand. Argentina’s soybean oil exports will also be constrained as higher soybean shipments to China reduce crushing activity. Compounding these pressures, India’s domestic soybean production is projected to fall by 1.5 million tonnes (-13.5%) due to adverse weather and reduced planting as farmers shift to more profitable crops such as maize.

Meanwhile, policy uncertainty in Indonesia continues to lend support to palm oil prices. Market reports suggest potential adjustments to export duties, while the timing of the shift to a higher biodiesel mandate—whether B45 or B50—remains a key determinant of exportable supplies in 2026.

Palm oil prices are expected to find strong support at RM4,000 (USD961)—RM4,100 (USD985) in December and could trend toward RM4,400 (USD1,057), driven by rising import demand ahead of Chinese New Year and Ramadan. Exceptionally strong production from July to October 2025 signals a sharper-than-usual seasonal decline in December and into Q1 2026, compounded by monsoon-related disruptions to harvesting.

Exchange Rate: USD1 = RM4.16