The Rise of ASEAN’s Foodservice Industry: An Engine for Palm Oil Demand

Palm oil plays a central role in this landscape as a versatile and essential ingredient in a wide range of food products, ensuring its continued relevance in ASEAN’s rapidly evolving consumer market.ASEAN remains one of the fastest-growing regions in the world. In 2024, with a population of 685 million, its nominal GDP reached USD3.84 trillion, led by Indonesia, Singapore, Thailand, Vietnam, and the Philippines. The strongest growth was recorded in the Philippines (6.2%), Vietnam (5.8%), and Cambodia (6.0%). Rising urbanisation, a young demographic, and an expanding middle class continue to drive robust consumer demand across the region.

The foodservice industry has become an integral part of this growth, shaped by evolving lifestyles and increasing demand for convenience and variety. Palm oil plays a central role in this landscape as a versatile and essential ingredient in a wide range of food products, ensuring its continued relevance in ASEAN’s rapidly evolving consumer market.

The ASEAN consumer foodservice sector has shown a strong recovery from the impact of COVID-19, growing from USD84 trillion in 2021 to USD123 trillion in 2024—an increase of 46.3%. This rebound was driven by the reopening of businesses, the restoration of consumer confidence, and the rising demand for dining out. Looking ahead, the sector is projected to sustain its momentum and reach USD170.6 trillion by 2029. This represents a five-year CAGR of 6.75%, underscoring the sector’s resilience and its key role in shaping ASEAN’s consumer market.

ASEAN Consumer Foodservice

Figure 1: ASEAN consumer foodservice sector, in USD million (Euromonitor, 2025).

Indonesia, Thailand, Vietnam, and the Philippines are the major contributors to the region’s consumer foodservice sector. With a population exceeding 280 million, Indonesia naturally leads the region by market size. Thailand follows closely, supported by its strong tourism industry, which sustains a diverse range of dining establishments catering to both locals and international visitors. Notably, both Indonesia and Thailand are major palm oil producers, where domestic consumption accounts for approximately 47% and 75% of total palm oil production, respectively.

What is particularly noteworthy is the rapid expansion of the consumer foodservice sectors in Vietnam and the Philippines. Unlike Indonesia and Thailand, these two nations are net importers of palm oil. However, they continue to record robust economic growth, with GDP rising by 7.1% in Vietnam and 5.7% in the Philippines. Each country also has a population exceeding 100 million, creating a strong and expanding consumer base. This combination of economic and demographic growth positions Vietnam and the Philippines among the most promising markets in ASEAN—where palm oil plays a vital role in supporting the continued expansion of their foodservice industries.

ASEAN Consumer Foodservice by Country, 2024

Figure 2: ASEAN consumer foodservice by country as of 2024 (Euromonitor, 2025).

The Next Frontier: Foodservice Growth in Vietnam and the Philippines

Consumer foodservice in Vietnam and the Philippines continues to demonstrate strong growth, driven by a rising middle class and a growing preference for dining out as both economies strengthen. Between 2024 and 2029, the sector is projected to record a five-year CAGR of 8.45% in Vietnam and 11.29% in the Philippines. The number of foodservice outlets is expected to increase in line with this growth, with Vietnam maintaining a larger outlet base—more than twice that of the Philippines. Furthermore, the steady influx of international tourists to both countries is expected to further bolster industry performance, stimulating higher sales across all segments of the foodservice market.

Vietnam & Philippines: Consumer Foodservice Value

Figure 3: Consumer foodservice sector value in USD million for Vietnam and Philippines (Euromonitor, 2025).

Number of Unit/Outlet of Consumer Foodservice

Table 1: Number of foodservice outlets by category in Vietnam and Philippines (Euromonitor, 2025).

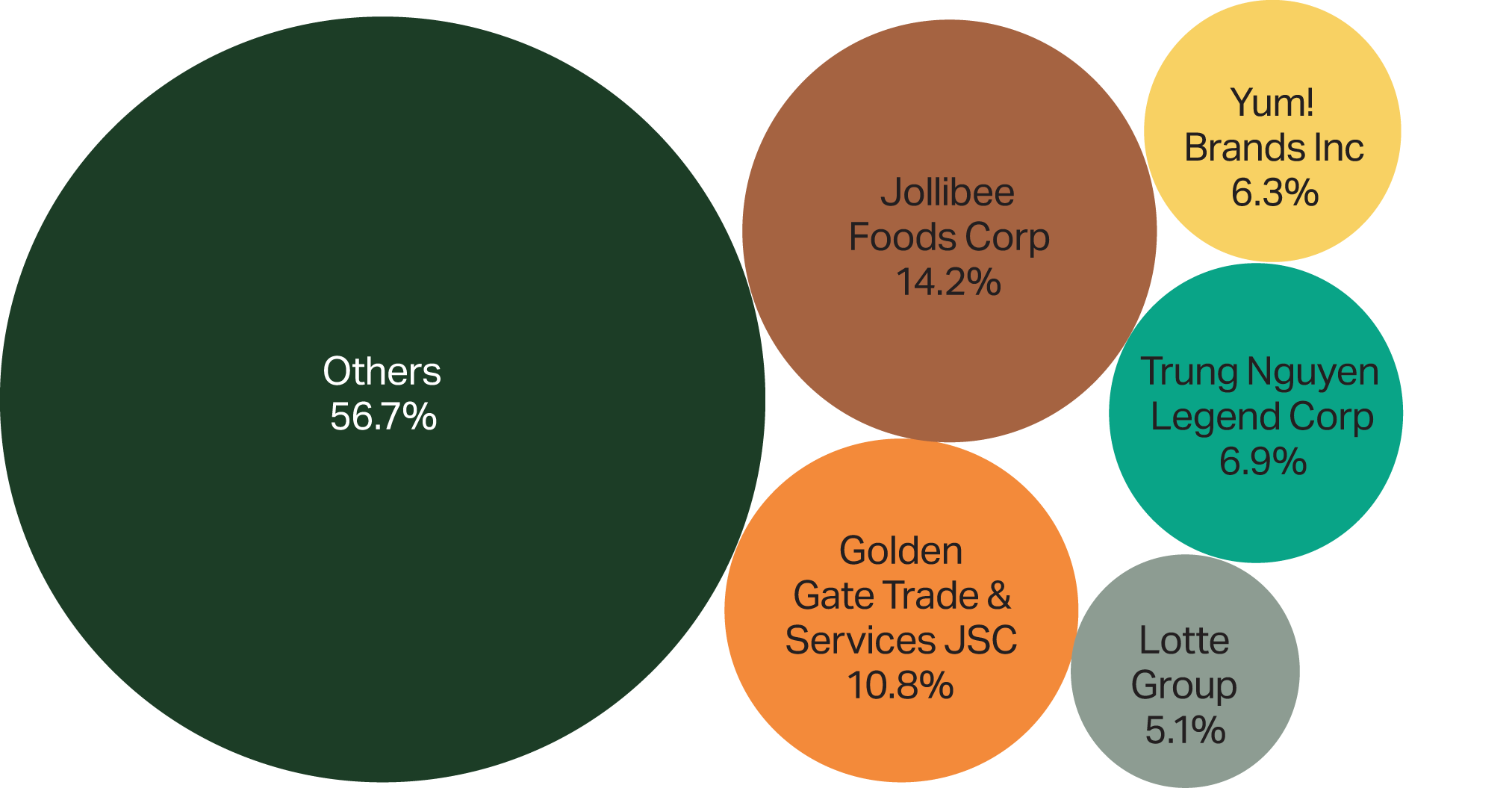

In Vietnam, Jollibee Foods Corporation and Golden Gate Trade & Services JSC hold the largest shares in the foodservice market. Jollibee’s ownership of Highlands Coffee, the country’s leading coffee chain, has strengthened its position, making Vietnam one of its largest markets outside the Philippines. Golden Gate, on the other hand, leads the full-service restaurant segment with popular brands such as Kichi Kichi, Gogi House, and Manwah. Asian-themed dining continues to resonate with Vietnamese consumers, reflecting both a strong appreciation for local flavours and a growing interest in Japanese and Korean cuisines.

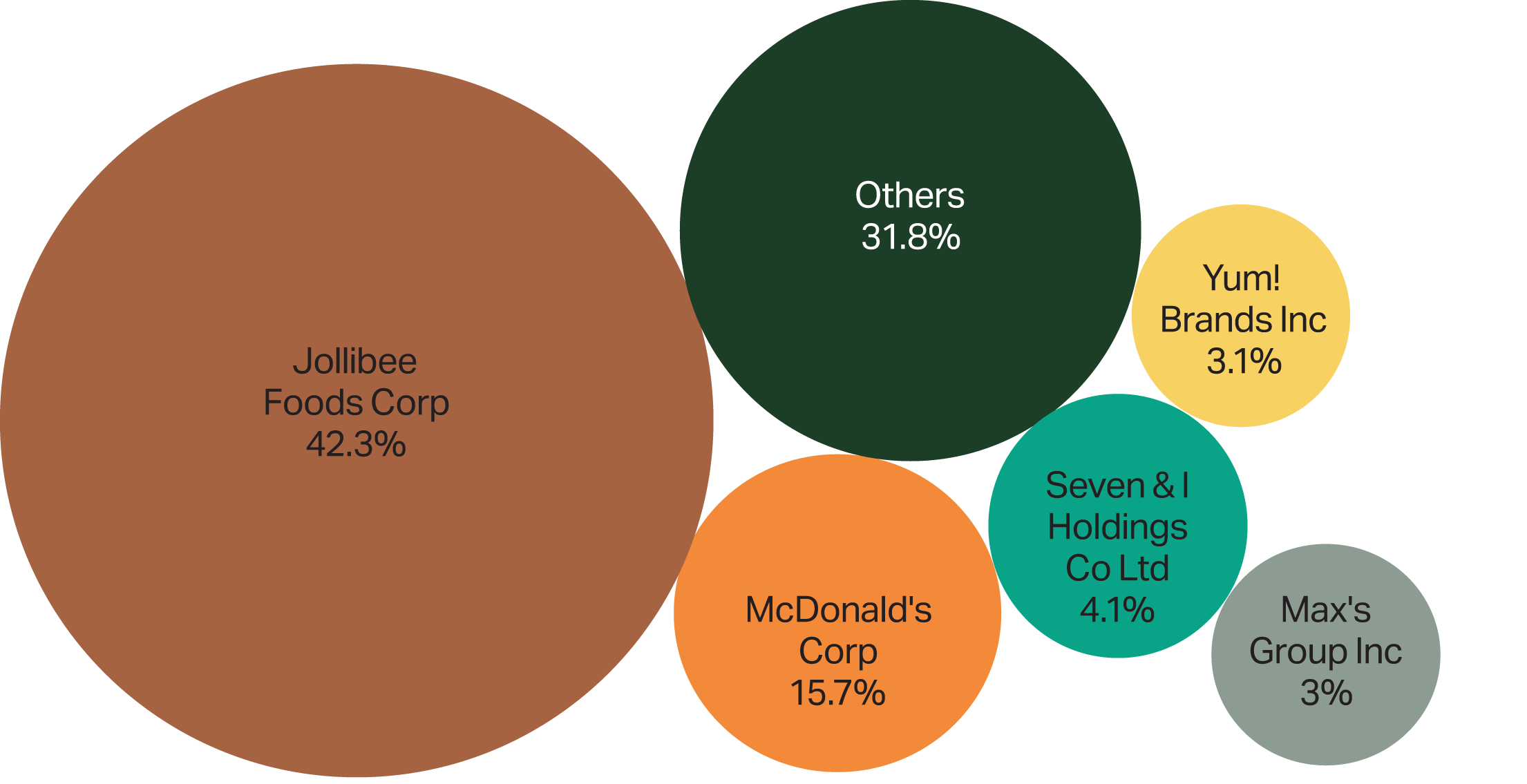

In the Philippines, Jollibee Foods Corporation remains the dominant force in the consumer foodservice industry, ahead of global competitors such as McDonald’s. Its continued success is driven by strong brand loyalty, constant innovation, and the adoption of digital platforms to engage younger consumers. The Philippines remains a promising market for both local and international brands, with newcomers such as Phuc Tea and Ai-CHA expanding rapidly to meet rising demand for diverse and trend-led dining options.

Major Players of Foodservice Industry in Vietnam, % Foodservice Value

Major Players of Foodservice Industry in Philippines, % Foodservice Value

Figure 4: Major players of foodservice industry in Vietnam, Philippines (Euromonitor, 2025).

Economic and Lifestyle Trends Shaping ASEAN’s Food Future

The foodservice sector in ASEAN—particularly in Vietnam and the Philippines —is growing rapidly due to several key factors driving consumer demand and market expansion. Rising incomes and the growth of the middle class are major catalysts for this expansion. As people earn more, they are spending more on eating out and exploring new culinary experiences. In Vietnam, an increasing number of young professionals and urban families prefer dining outside the home. In the Philippines, steady income growth and remittances from overseas workers are helping families incorporate dining out as part of their everyday lifestyle.

Tourism and hospitality also play a crucial role in supporting foodservice growth. Vietnam continues to attract a growing number of international visitors, increasing demand for restaurants, cafés, and street food outlets. Similarly, the Philippines is experiencing rising domestic and international tourism, helping foodservice operators expand their reach. Tourists seeking both local and international flavours are creating new opportunities for the food industry to thrive.

Lifestyle changes and global food trends are further shaping eating habits in both countries. Busy working adults and dual-income households are opting for convenient, quick, and affordable meal options. At the same time, international food brands and fusion cuisines are gaining popularity, blending local tastes with global influences. These shifts are helping to make the foodservice industries in Vietnam and the Philippines more diverse, dynamic, and competitive.

Feeding the Industry: How Foodservice Expansion Drives Palm Oil Use

The expansion of the foodservice sector in ASEAN is closely linked to the rising demand for palm oil. As the industry grows and more meals are prepared commercially, palm oil usage continues to rise because of its versatility, cost efficiency, and reliability in large-scale food preparation. Restaurants, cafes, and catering services rely on palm oil for a broad range of cooking applications, making it an indispensable part of the region’s food economy.

The concurrent expansion of the food manufacturing sector has further reinforced this trend. Many food products, including baked goods and snacks, incorporate palm oil or its derivatives to enhance texture, flavour, and shelf life. As consumer demand for convenient and ready-to-eat options increases, palm-based ingredients continue to play a critical role in supporting production requirements.

In Indonesia and Malaysia, strong domestic consumption keeps palm oil deeply integrated into both household and commercial food use. Meanwhile, in Vietnam and the Philippines, the rapid growth of quick-service restaurant chains and industrial food production has led to higher imports of edible oils, primarily palm oil. This trend underscores how expanding food-related industries continue to drive demand for palm oil across the region.

The strong correlation between palm oil consumption and the growth of the foodservice sector reflects how closely both industries move in tandem. As the region’s dining and hospitality markets expand, demand for palm oil is expected to continue rising, supported by its essential role in food preparation and manufacturing. The increasing number of restaurants, cafés, and food outlets—combined with shifting consumer lifestyles and a growing middle class—will further reinforce this upward trajectory.

ASEAN Palm Oil Consumption and Consumer Foodservice Value Trends (2020–2029F)

Figure 5: ASEAN palm oil consumption and consumer foodservice value trends from 2020 to 2029F (Euromonitor, Oil World & MPOC Estimates, 2025).

Sustaining Growth Through Palm Oil

The expansion of ASEAN’s foodservice sector reflects the region’s broader transformation in consumer lifestyles, income patterns, and trade integration. As Vietnam and the Philippines continue to strengthen their dining industries and attract both local and international players, palm oil remains a vital component supporting this progress. Its versatility, functionality, and accessibility make it indispensable within the food value chain—from small eateries to industrial food manufacturing.

Moving forward, the parallel growth of palm oil consumption and foodservice activities underscores ASEAN’s position as a dynamic and interconnected market, where economic development, cultural exchange, and sustainable commodity use will continue to define the region’s evolving food future.